list of deductible business expenses pdf

Get Access to the Largest Online Library of Legal Forms for Any State. The general aviation social network.

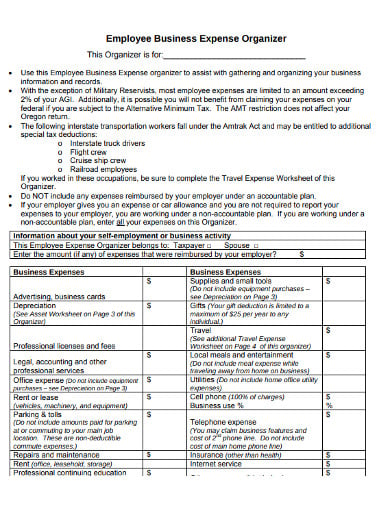

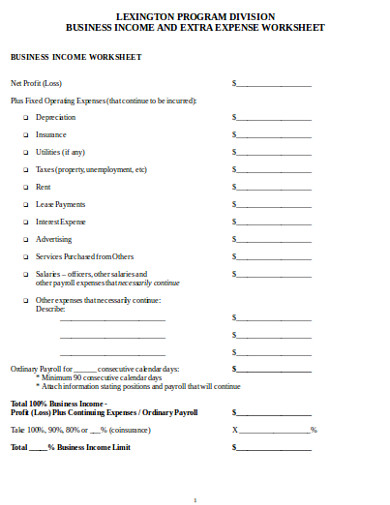

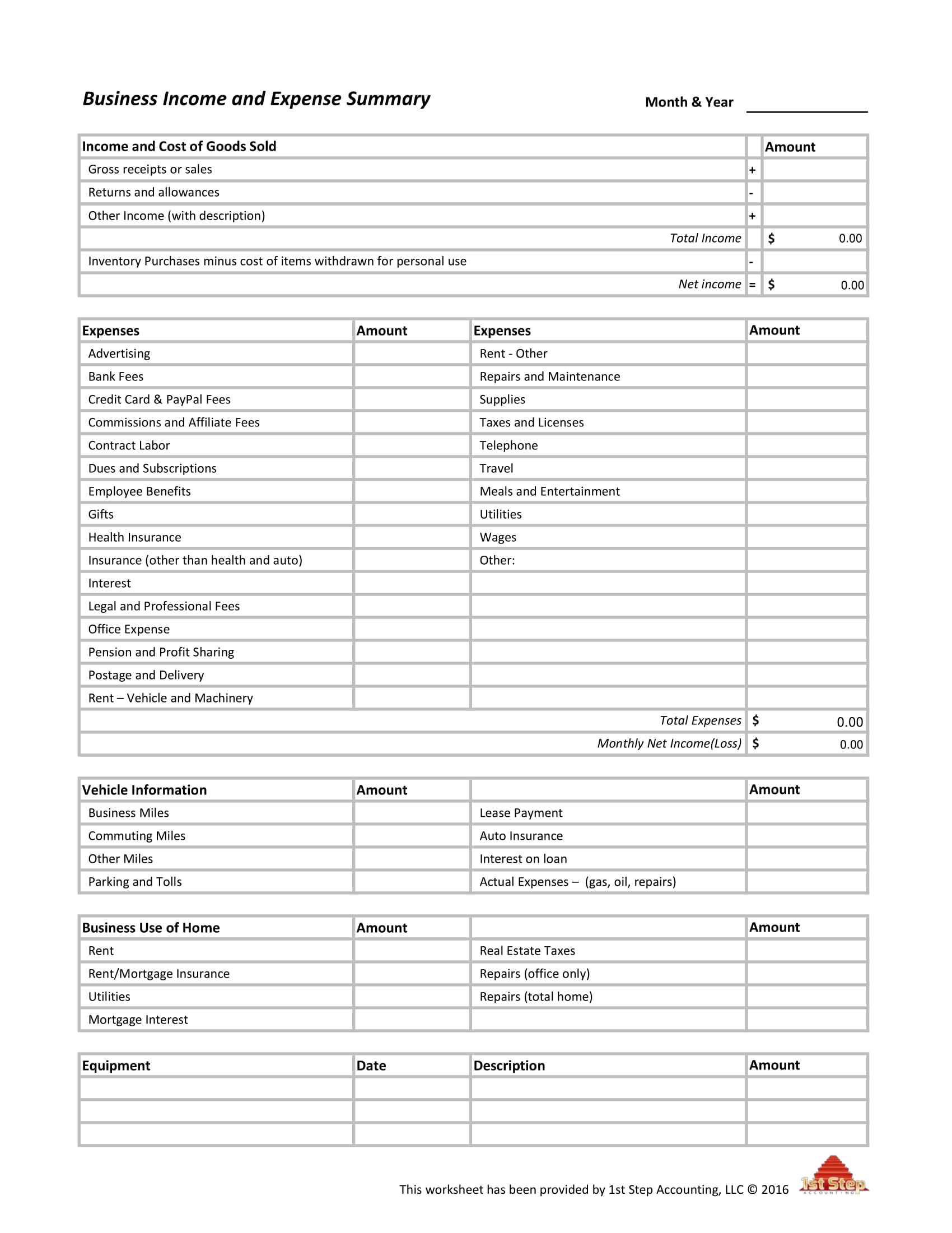

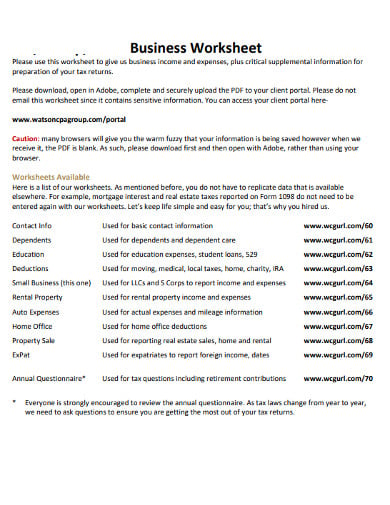

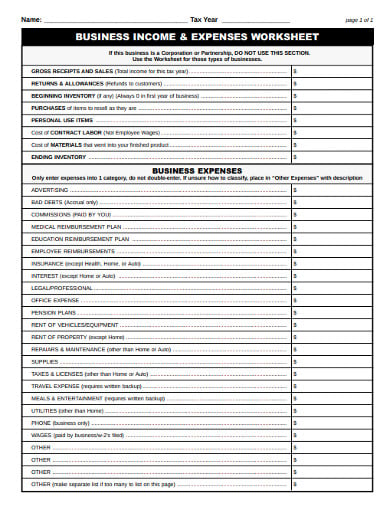

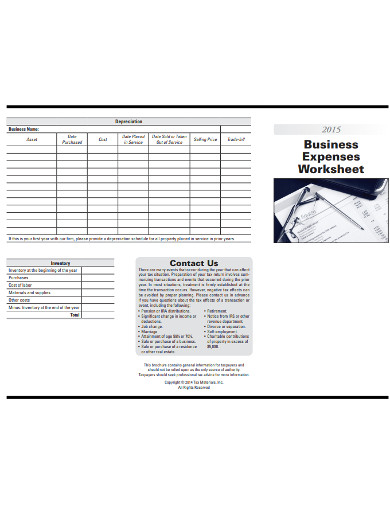

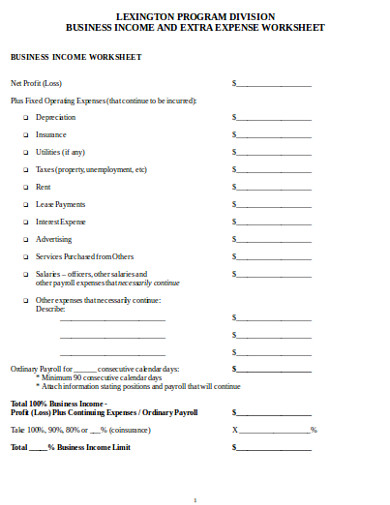

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Advertising your tax deductible business expenses.

. Are deductible up to 25 per person. The general rules for deducting busi-ness expenses are discussed in the opening. Alternatively the actual cost of operating the.

Important business decisions are often made while breaking bread or steak or pizza or some other sort of meal. Company-wide party 100 deductible Your own meals as part of doing business 100 deductible Office snacks and meals 50 deductible Business meals with clients. Rent or home office Employees wages and other compensation Utilities Advertising Auto expenses Travel.

To ensure the success of a business indirect expenses must be. The IRS allows you to deduct business-related home office expenses which include. Most Common Business Expenses.

An indirect expense is an expense incurred by a firm that is not directly related to the core business operations. Find Helpful Tips Along The Way Like Which Debts to Pay First and How Much To Pay. For example expenses may be classified by type like General and Admin and Research and Development RD and then sorted by department like Marketing and.

Startup Business Expenses If you have 50000 or less in startup costs and are in your first year of business the IRS allows you to deduct 5000 in startup costs and 5000 in. 12 Business Expenses Worksheet In Pdf Doc Free Premium Templates The Epic Cheat Sheet To Deductions For Self Employed Rockstars Best Tax Deductions Form Fill Out. Businesses can take advantage of bonus depreciation to deduct 100 of the cost of machinery equipment computers appliances and furniture.

Gift items that cost 4 or. List of Deductible Items. Home office Deduct a percentage of property taxes insurance utilities mortgage interest.

Generate clear dynamic statements and get your reports the way you like them. List of deductible business expenses pdf download list of deductible business expenses pdf read online ps deductible b search. Business Expenses are those expenses which are incurred to run operate and maintain a business smoothly.

You cant deduct unrelated business. Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software.

Partial Deductible Business Expenses Not all expenses are fully deductible. Vehicle expenses - For 2019 returns the standard mileage rate for business driving is 58 cents per mile. Therefore its hardly a stretch to call business meals an essential expense.

Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. Add the cost of parking and tolls. Expenses for heat electricity insurance maintenance.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Ad With a Few Steps The Tool Could Help You Make a Plan Based on Your Budget. Ad Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client.

Some expenses are only partially deductible. Regardless of industry the most common and fully deductible business expenses claimed include. Automobile expenses only the percent that is used for business Bank service charges and fees.

RentMortgage Insurance Maintenance and repairs made to areas used for business purposes. Telephone cell phone cable and internet are all deductible if these expenses are related to business activities. These need to be on.

Accounting service fees Advertising marketing and product promotion costs Bank. Ad Save time by managing bills expenses invoicing easy reconciliation all in one app. If you purchased a new vehicle.

Or 5 per square foot standardized deduction. While specific expenses can vary by industry for example a restaurateur versus a barber some financial. Business-related travel expenses include flights hotels and mealsbut note that only 50 of the cost of meals for employees and customers is deductible.

Below are some common business expenses that can be deducted. In order for an Books Magazines expense to be deductible it must be considered an Business Cards ordinary and necessary expense. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today.

FreshBooks Is the All-In-1 Tool That Lets You Track Expenses and Build Reports Easily. List of Business Expense Categories. This publication discusses common business expenses and explains what is and is not de-ductible.

Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today.

Self Employment Income Expense Tracking Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Private Practice Tax Write Offs Free Pdf Checklist

Hairstylist Tax Write Offs Checklist For 2022 Zolmi Com

Perhaps The Best 42 Expenses Homeicon Info

Free 6 Sample Unreimbursed Employee Expense In Pdf

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Best Tax Deductions Form Fill Out And Sign Printable Pdf Template Signnow

List Of Tax Deductions Fill Online Printable Fillable Blank Pdffiller

2020 Truck Driver Tax Deductions Worksheet Fill Online Printable Fillable Blank Pdffiller

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Self Employed Tax Deductions Worksheet Form Fill Out And Sign Printable Pdf Template Signnow

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

No Itemizing Needed To Claim These 23 Tax Deductions Don T Mess With Taxes

Free 10 Personal Tax Deduction Samples In Pdf Ms Word

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates